ការប្រជុំធ្វើផែនការរួមគណនេយ្យសង្គមនៅឃុំអណ្ដូងពោធិ៍ ស្រុករមាសហែក ខេត្តស្វាយរៀង។ រូបថត ថតដោយក្រុមការងារអង្គការទិន្នន័យអំពីការអភិវឌ្ឍ នៅថ្ងៃទី២៦ ខែមិថុនា ឆ្នាំ២០១៨។ ក្រោយអាជ្ញាប័ណ្ណ CC BY-SA 4.0

ថវិការបស់រដ្ឋបាលក្រុង ខណ្ឌ និងឃុំ សង្កាត់ត្រូវបានរាប់បញ្ចូលក្រោមថវិការបស់ក្រុងដែលខ្លួនស្ថិតនៅក្រោម។ ថវិកាទាំងនេះគឺផ្អែកលើការបែងចែក និងផ្ទេរថវិកាឃុំ សង្កាត់ និងចំណូលដែលប្រមូលដោយរដ្ឋបាលក្រុង ខណ្ឌ និងឃុំ សង្កាត់។ ថវិកាទាំងនេះត្រូវបានផ្អែកលើគោលបំណងនៃគោលនយោបាយ កម្មវិធី អនុកម្មវិធី និងអាទិភាព និងចង្កោមសកម្មភាពដែលពណ៌នាអំពីគោលបំណង និងសូចនាករគោលដៅ ពេលវេលា និងថវិកាដែលត្រូវការ។

មាត្រា ១៤៦ នៃរដ្ឋធម្មនុញ្ញកម្ពុជាផ្តល់ជាមូលដ្ឋានគតិយុត្តិនៃរដ្ឋបាលថ្នាក់ក្រោមជាតិដោយមានបទប្បញ្ញត្តិសម្រាប់ការអនុម័តច្បាប់រៀបចំអង្គការដែលនៅតែត្រូវបំពេញ។1 ច្បាប់រៀបចំអង្គការត្រូវបានគេរំពឹងថា នឹងកំណត់តួនាទី និងទំនាក់ទំនងរបស់ខេត្ត ស្រុក និងឃុំដើម្បីបែងចែកឱ្យបានកាន់តែច្បាស់រវាងរចនាសម្ព័ន្ធអភិបាលកិច្ចជនបទ និងទីប្រជុំជន និងផ្តល់មូលដ្ឋានច្បាប់សម្រាប់ការបែងចែកមុខងារ និងប្រាក់ចំណូលដល់អង្គភាពថ្នាក់ក្រោមជាតិ។ បញ្ហាសំខាន់ៗជាច្រើនទៀតនៅតែត្រូវដោះស្រាយឱ្យបានគ្រប់ជ្រុងជ្រោយ៖ ការកែលម្អតម្លាភាព និងគណនេយ្យភាពនៅក្នុងយន្តការរដ្ឋបាលមូលដ្ឋាន ធនធានមនុស្សនៅរដ្ឋបាលមូលដ្ឋាន សមត្ថភាពកៀរគរចំណូលឃុំ និងការចូលរួមដ៏មានប្រជាប្រិយក្នុងការធ្វើសេចក្តីសម្រេចចិត្តក្នុងមូលដ្ឋាន ក៏ដូចជាក្នុងការអភិវឌ្ឍមូលដ្ឋាន។

ផ្អែកលើច្បាប់ស្តីពី ប្រព័ន្ធហិរញ្ញវត្ថុសាធារណៈ និងច្បាប់ស្តីពី របបហិរញ្ញវត្ថុ និងការគ្រប់គ្រងទ្រព្យសម្បត្តិរបស់រដ្ឋបាលថ្នាក់ក្រោមជាតិដែលត្រូវបានអនុម័តកាលពីថ្ងៃទី៣១ ខែឧសភា ឆ្នាំ២០១១ មានគោលបំណងកំណត់របបហិរញ្ញវត្ថុ និងការគ្រប់គ្រងទ្រព្យសម្បត្តិរបស់រដ្ឋបាលថ្នាក់ក្រោមជាតិនៅកម្ពុជា។ ច្បាប់នេះស្វែងរកការបង្កើតប្រភពហិរញ្ញវត្ថុសម្រាប់រដ្ឋបាលថ្នាក់ក្រោមជាតិ ដើម្បីមានសមត្ថភាពគ្រប់គ្រាន់ក្នុងការអភិវឌ្ឍមូលដ្ឋានរបស់ពួកគេ។ វិសាលភាពនៃប្រតិបត្តិការរបស់ច្បាប់នេះគ្របដណ្តប់លើរបបហិរញ្ញវត្ថុ និងការគ្រប់គ្រងទ្រព្យសម្បត្តិរបស់រដ្ឋបាលរាជធានី ខេត្ត ក្រុង ស្រុក និងខណ្ឌ។ ច្បាប់នេះមិនបានចែងអំពីប្រតិបត្តិការរបបហិរញ្ញវត្ថុ និងការគ្រប់គ្រងទ្រព្យសម្បត្តិរបស់រដ្ឋបាលឃុំ សង្កាត់ទេ។ ទាំងនេះត្រូវបានកំណត់ដោយច្បាប់ស្តីពី ការគ្រប់គ្រងរដ្ឋបាលឃុំ សង្កាត់។2

ច្បាប់រៀបចំអង្គការ ឆ្នាំ២០០៨ ផ្តល់មូលដ្ឋានរដ្ឋបាលស្នូលសម្រាប់កំណែទម្រង់វិសហមជ្ឈការ និងវិមជ្ឈការ។3 ច្បាប់រៀបចំអង្គការបញ្ជាក់ពីអំណាចរបស់រដ្ឋបាលថ្នាក់ក្រោមជាតិស្របតាមរដ្ឋធម្មនុញ្ញ និងស្របតាមគោលការណ៍នៃរដ្ឋបាលបង្រួបបង្រួមប្រជាធិបតេយ្យនៅក្នុងរដ្ឋបង្រួបបង្រួម។ រដ្ឋបាលថ្នាក់ក្រោមជាតិដែលបានកំណត់ទាំងអស់គឺជានីតិបុគ្គល ហើយមានក្រុមប្រឹក្សាជ្រើសរើសជាផ្លូវការ។ អង្គភាពនានាលើកកម្ពស់លទ្ធិប្រជាធិបតេយ្យតាមរយៈការតំណាងជាសាធារណៈស្វ័យភាពមូលដ្ឋានការពិគ្រោះយោបល់ និងការចូលរួមរបស់ពលរដ្ឋការឆ្លើយតប និងទំនួលខុសត្រូវការលើកកម្ពស់គុណភាពជីវិត សមធម៌ សុចរិតភាព និងតម្លាភាព និងការអនុវត្តប្រឆាំងអំពើពុករលួយ។

យោងតាមមាត្រា ៣៥ នៃច្បាប់ស្តីពីរបបហិរញ្ញវត្ថុ និងការគ្រប់គ្រងទ្រព្យសម្បត្តិសម្រាប់រដ្ឋបាលថ្នាក់ក្រោមជាតិ ប្រតិទិនសម្រាប់សេចក្តីព្រាងច្បាប់ស្តីពីហិរញ្ញវត្ថុសម្រាប់ការគ្រប់គ្រងប្រចាំឆ្នាំត្រូវបានបែងចែកជា ៣ ដំណាក់កាល។4

- ការរៀបចំផែនការយុទ្ធសាស្ត្រថវិកា (ចាប់ពីខែមីនា ដល់ ឧសភា)៖

- នៅពេលទទួលបានសារាចរណែនាំស្តីពី ការរៀបចំផែនការយុទ្ធសាស្ត្រថវិកាដែលចេញដោយរដ្ឋមន្ត្រីក្រសួងសេដ្ឋកិច្ច និងហិរញ្ញវត្ថុ ក្រសួង ស្ថាប័ន និងអង្គភាពទាំងអស់ជូនដំណឹងដល់ក្រុមប្រឹក្សានីមួយៗអំពីកម្មវិធី និងការព្យាករថវិកាក្នុងវិស័យរបស់ពួកគេដែលចាំបាច់ត្រូវអនុវត្ត។

- ការរៀបចំកញ្ចប់ថវិកា (ចាប់ពីខែមិថុនា ដល់ ខែកញ្ញា)៖

- នៅសប្តាហ៍ដំបូងនៃខែមិថុនា រដ្ឋមន្ត្រីក្រសួងសេដ្ឋកិច្ច និងហិរញ្ញវត្ថុរៀបចំជាសារាចរណែនាំដល់រដ្ឋបាលថ្នាក់ក្រោមជាតិស្តីពីបច្ចេកទេសសម្រាប់ការរៀបចំផែនការថវិកា។ សារាចរនេះបញ្ជាក់ពីទម្រង់ នីតិវិធី និងឯកសារគាំទ្រនានាដែលត្រូវប្រើដើម្បីរៀបចំផែនការចំណូល និងចំណាយលម្អិត។

- ការអនុម័តថវិកាសម្រាប់រដ្ឋបាលថ្នាក់ក្រោមជាតិ (ពីខែតុលា ដល់ ខែធ្នូ)៖

- នៅក្នុងសប្តាហ៍ដំបូងនៃខែតុលា ក្រសួងសេដ្ឋកិច្ច និងហិរញ្ញវត្ថុដាក់ផែនការថវិការបស់រដ្ឋបាលថ្នាក់ក្រោមជាតិ។

ដំណាលគ្នានេះដែរ រាជរដ្ឋាភិបាលកម្ពុជាចេញសារាចរស្តីពី ផែនការយុទ្ធសាស្ត្រថវិកាជាតិ និងសារាចរស្តីពី ផែនការយុទ្ធសាស្ត្រថវិកាថ្នាក់ក្រោមជាតិ ដើម្បីផ្តល់នូវគោលការណ៍ថ្មីៗ និងគោលការណ៍បច្ចេកទេសសំខាន់ៗសម្រាប់ធ្វើបច្ចុប្បន្នភាពផែនការថវិកាយុទ្ធសាស្ត្រ។ ផែនការថវិកាយុទ្ធសាស្ត្រ គឺជាផែនការ៣ឆ្នាំរំកិល ដែលត្រូវបានរៀបចំឡើងជារៀងរាល់ឆ្នាំដោយរដ្ឋបាលក្រុង ខេត្តដោយអនុវត្តតាមវិធីសាស្ត្រពីក្រោមឡើងលើ។ ផែនការអភិវឌ្ឍ ៥ ឆ្នាំត្រូវបានរៀបចំឡើងរៀងរាល់ ៥ ឆ្នាំម្តង ហើយកម្មវិធីវិនិយោគបីឆ្នាំរំកិលត្រូវបានធ្វើបច្ចុប្បន្នភាពជារៀងរាល់ឆ្នាំ។

ការចំណាយសរុបនៅថ្នាក់ក្រោមជាតិ

មានការចំណាយគួរឱ្យកត់សម្គាល់នៅក្នុងការចំណាយសរុបតែនាម (និងពិត) ក្នុងអំឡុងឆ្នាំ ២០០៨-២០១៦ ។ ការចំណាយសរុបរបស់រដ្ឋបាលថ្នាក់ក្រោមជាតិបានកើនឡើងពី ៤២០,៣ ពាន់លានរៀល ដល់ ១.៣២០,៨ ពាន់លានរៀលដោយមានកំណើនតែនាម ១៥,៤ ភាគរយ និងកំណើនពិត ១២,៨ ភាគរយ ក្នុងមួយឆ្នាំ។5 កំណើនចំណាយដ៏សំខាន់បំផុតបានកើតឡើងនៅតាមបណ្តារដ្ឋបាលខេត្ត និងរាជធានី (១៣,២ ភាគរយ តែនាម និង ១១,០ ភាគរយ ពិតក្នុងមួយឆ្នាំ) ។ កំណើនឃុំ សង្កាត់គឺទាបជាងបន្តិចនៅត្រឹម ១២,១ ភាគរយ តែមាន និង ១០,០ ភាគរយ ពិតក្នុងមួយឆ្នាំ។6

ចាប់ផ្តើមពីមូលដ្ឋានទាបបំផុតក្នុងឆ្នាំ២០១២ និងជាមួយឆ្នាំដំបូងនៃការអនុវត្តសន្សឹមៗ ចំណាយស្រុក និងក្រុងបានកើនឡើងយ៉ាងឆាប់រហ័សក្នុងអំឡុងពេលនេះដោយមានអត្រា ៤០,២ ភាគរយតែនាម និង ៣៣,៤ ភាគរយពិត ក្នុងមួយឆ្នាំ ទោះបីមូលនិធិក្នុងមនុស្សម្នាក់នៅទាបក៏ដោយ។ តាមសមាមាត្រនៃផលិតផលក្នុងស្រុកសរុប (ផ.ស.ស) ការចំណាយសរុបរបស់រដ្ឋបាលថ្នាក់ក្រោមជាតិបានកើនឡើងពី ១,០ ភាគរយ នៃ ផ.ស.ស ក្នុងឆ្នាំ២០០៨ ដល់ ១,៦ ភាគរយ នៅឆ្នាំ២០១៦។7

ប្រភពថវិកាស្នូលរដ្ឋបាលថ្នាក់ក្រោមជាតិ

រូបភាពទី ១ កំណត់ប្រភពថវិកាស្នូលសម្រាប់រដ្ឋបាលថ្នាក់ក្រោមជាតិ៖

- ពន្ធដែលបានចែករំលែកដោយរដ្ឋាភិបាល (ខេត្ត និងរាជធានីភ្នំពេញតែប៉ុណ្ណោះ)

- ចំណូលមិនមែនសារពើពន្ធ

- ការផ្ទេរគ្មានភ្ជាប់លក្ខខណ្ឌផ្អែកលើរូបមន្តពីរដ្ឋាភិបាលកណ្តាល

- ការផ្ទេរគ្មានភ្ជាប់លក្ខខណ្ឌពីរដ្ឋាភិបាលកណ្តាល (ខេត្ត)

- ការផ្ទេរលក្ខខណ្ឌពីរដ្ឋាភិបាលកណ្តាល (រួមទាំង មូលនិធិវិនិយោគសម្រាប់រដ្ឋបាលថ្នាក់ក្រោមជាតិ)

- ការផ្ទេរដោយមានលក្ខខណ្ឌ និងគ្មានភ្ជាប់លក្ខខណ្ឌពីខេត្ត និងរាជធានីភ្នំពេញទៅស្រុក ក្រុង និងខណ្ឌ

- ការផ្ទេរដោយមានភ្ជាប់លក្ខខណ្ឌ និងគ្មានភ្ជាប់លក្ខខណ្ឌពីស្រុក ក្រុង ទៅឃុំ និងសង្កាត់

- ថវិកាផ្សេងទៀតរួមទាំងមូលនិធិដៃគូអភិវឌ្ឍន៍។ ការផ្ទេរភាគច្រើនពីកម្រិតខ្ពស់ទៅថ្នាក់ក្រោមជាតិគឺតិចតួច។ ទោះយ៉ាងណារាជធានីភ្នំពេញផ្តល់ថវិកាដោយផ្ទាល់ដល់ខណ្ឌទាំង ១២ របស់ខ្លួនដែលក្នុងឆ្នាំ ២០១៥ មានចំនួន ៨៥ ភាគរយ នៃការផ្ទេរគ្មានភ្ជាប់លក្ខខណ្ឌផ្អែកលើរូបមន្តសរុបពីរដ្ឋាភិបាលកណ្តាល (មូលនិធិក្រុង ស្រុក)

រូបភាពទី ១ ប្រភពថវិកាស្នូលសម្រាប់កម្រិតផ្សេងៗគ្នានៃរដ្ឋបាលថ្នាក់ក្រោមជាតិ8

| ប្រភពថវិកាស្នូលសម្រាប់រដ្ឋបាលថ្នាក់ក្រោមជាតិ | ||

| ខេត្ត និងរាជធានីភ្នំពេញ | ស្រុក ក្រុង និងខណ្ឌ | ឃុំ និងសង្កាត់ |

| ពន្ធដែលបានចែករំលែកដោយរដ្ឋាភិបាល | ចំណូលមិនមែនសារពើពន្ធ | ចំណូលមិនមែនសារពើពន្ធ |

| ចំណូលមិនមែនសារពើពន្ធ | ការផ្ទេរគ្មានភ្ជាប់លក្ខខណ្ឌផ្អែកលើរូបមន្តពីរដ្ឋាភិបាលកណ្តាល (មូលនិធិក្រុង ស្រុក) | ការផ្ទេរគ្មានភ្ជាប់លក្ខខណ្ឌផ្អែកលើរូបមន្តពីរដ្ឋាភិបាលកណ្តាល (មូលនិធិឃុំ សង្កាត់) |

| ការផ្ទេរគ្មានភ្ជាប់លក្ខខណ្ឌផ្អែកលើរូបមន្តពីរដ្ឋាភិបាលកណ្តាល | ការផ្ទេរមានភ្ជាប់លក្ខខណ្ឌពីរដ្ឋាភិបាលកណ្តាល (រួមទាំង មូលនិធិវិនិយោគសម្រាប់រដ្ឋបាលថ្នាក់ក្រោមជាតិ) | ការផ្ទេរមានភ្ជាប់លក្ខខណ្ឌពីរដ្ឋាភិបាលកណ្តាល (រួមទាំង មូលនិធិវិនិយោគសម្រាប់រដ្ឋបាលថ្នាក់ក្រោមជាតិដែលមានសក្តានុពល) |

| ការផ្ទេរគ្មានភ្ជាប់លក្ខខណ្ឌពីរដ្ឋាភិបាលកណ្តាល | ការផ្ទេរដោយមានលក្ខខណ្ឌ និងគ្មានភ្ជាប់លក្ខខណ្ឌពីខេត្ត និងរាជធានីភ្នំពេញ (ដែលផ្តល់ថវិកាដោយផ្ទាល់ដល់ខណ្ឌរបស់ខ្លួន) | ការផ្ទេរដោយមានភ្ជាប់លក្ខខណ្ឌ និងគ្មានភ្ជាប់លក្ខខណ្ឌពី ស្រុក ក្រុង ខណ្ឌ |

| ការផ្ទេរមានភ្ជាប់លក្ខខណ្ឌពីរដ្ឋាភិបាលកណ្តាល (រួមទាំង មូលនិធិវិនិយោគសម្រាប់រដ្ឋបាលថ្នាក់ក្រោមជាតិដែលមានសក្តានុពល) | ថវិកាផ្សេងទៀតរួមទាំងមូលនិធិដៃគូអភិវឌ្ឍន៍ | ថវិកាផ្សេងទៀតរួមទាំងមូលនិធិដៃគូអភិវឌ្ឍន៍ |

| ថវិកាផ្សេងទៀតរួមទាំងមូលនិធិដៃគូអភិវឌ្ឍន៍ | ||

ថវិកាឃុំ សង្កាត់

ឃុំមិនមានថវិកាអភិវឌ្ឍន៍ឃុំ សង្កាត់ មុនពេលមានកំណែទម្រង់វិមជ្ឈការទេ។ ចាប់តាំងពីពេលនោះមក ថវិកាតិចតួចបានផ្តល់ជូនឃុំ សង្កាត់នូវឱកាសដើម្បីអនុវត្តដំណើរការសម្រេចចិត្ត និងបង្ហាញថា ពួកគេអាចគ្រប់គ្រងគម្រោងតូចៗបាន។ ក្រុមប្រឹក្សាត្រូវរៀបចំ និងអនុម័តថវិកាប្រចាំឆ្នាំដោយអនុលោមតាមប្រតិទិនថវិកាជាតិ។ យោងតាមផ្នែកទី៧ នៃច្បាប់ស្តីពី ការគ្រប់គ្រងរដ្ឋបាលឃុំ សង្កាត់ ថវិកាត្រូវមានតុល្យភាពដោយគ្មានឱនភាព បំណុល ឬកាតព្វកិច្ចហិរញ្ញវត្ថុ។ ថវិកាគួរឆ្លុះបញ្ចាំងពីអាទិភាពដូចមានចែងក្នុងផែនការ និងកម្មវិធីវិនិយោគ។ នីតិវិធីសម្រាប់ការរៀបចំ និងអនុម័តថវិកាត្រូវបានកំណត់ដោយអនុក្រឹត្យ។ ការអត្ថាធិប្បាយនាពេលថ្មីៗនេះបានបង្ហាញថា មានភាពប្រសើរឡើងសម្រាប់ដំណើរការរៀបចំថវិកាក្នុងតំបន់។9

ច្បាប់ស្តីពី ការគ្រប់គ្រងរដ្ឋបាលឃុំ សង្កាត់ (២០០១)10 បានកំណត់ថា ក្រុមប្រឹក្សាឃុំ សង្កាត់ត្រូវរៀបចំផែនការអភិវឌ្ឍរយៈពេល ៥ ឆ្នាំ និងផែនការវិនិយោគបីឆ្នាំរំកិល។ ច្បាប់នេះមានគោលការណ៍បច្ចេកទេសក្នុងការរៀបចំ និងអនុវត្តផែនការអភិវឌ្ឍន៍ឃុំ សង្កាត់ប្រកបដោយប្រសិទ្ធភាពតម្លាភាព គណនេយ្យភាព និងការចូលរួមពេញលេញរបស់ប្រជាពលរដ្ឋ និងអ្នកពាក់ព័ន្ធទាក់ទងនឹងបញ្ហាបច្ចុប្បន្ន សមធម៌សង្គម និងការប្រែប្រួលអាកាសធាតុ។

ដំណើរការនៃការរៀបចំផែនការអភិវឌ្ឍនៅថ្នាក់ឃុំសង្កាត់មានកិច្ចការធំពីរ។ ទី ១ រៀបចំផែនការអភិវឌ្ឍឃុំ សង្កាត់រយៈពេល ៥ ឆ្នាំ (CDP) ពេញលេញ និងទី ២ ពិនិត្យ និងធ្វើបច្ចុប្បន្នភាពផែនការវិនិយោគឃុំប្រចាំឆ្នាំ (CIP) ។ នៅក្នុងដំណើរការរៀបចំផែនការអភិវឌ្ឍឃុំ សង្កាត់ ក្រុមប្រឹក្សាឃុំ សង្កាត់ពិចារណាលើយុទ្ធសាស្ត្រសម្រាប់ហេដ្ឋារចនាសម្ព័ន្ធរូបវ័ន្ត និងហេដ្ឋារចនាសម្ព័ន្ធអរូបវន្តដែលមានគោលបំណងដោះស្រាយសេចក្តីត្រូវការរបស់ប្រជាពលរដ្ឋ។

ដំណើរការរៀបចំផែនការរបស់ក្រុមប្រឹក្សាឃុំ សង្កាត់បង្ហាញពីកម្រិតជាក់លាក់នៃការចូលរួមពីប្រជាពលរដ្ឋ និងភាពជាដៃគូរវាងអ្នកពាក់ព័ន្ធ។11 សិក្ខាសាលាសមាហរណកម្មថ្នាក់ស្រុកបង្ហាញពីសារៈសំខាន់នៃការចូលរួមរបស់អង្គការក្រៅរដ្ឋាភិបាល បណ្តាមន្ទីរ និង ក្រុមប្រឹក្សាឃុំ សង្កាត់ ក្នុងការចែករំលែកព័ត៌មានដើម្បីឆ្លើយតបទៅនឹងអាទិភាពឃុំ សង្កាត់។ ក្រុមប្រឹក្សាឃុំ សង្កាត់ក៏អាចធ្វើការស្នើសុំ និងអំពាវនាវឱ្យមានការគាំទ្រពីខាងក្រៅដល់តំបន់របស់ពួកគេផងដែរ។

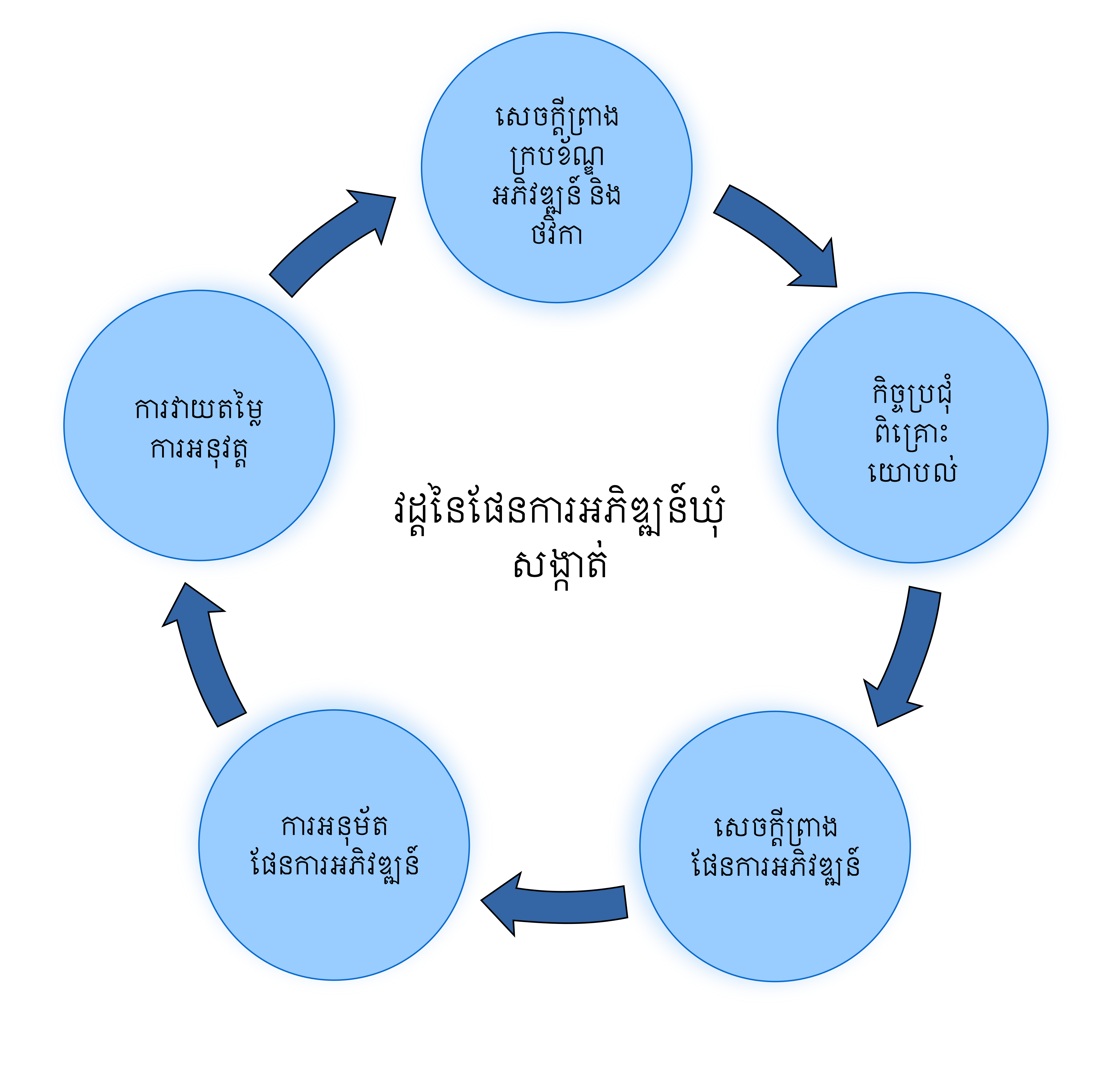

វដ្តនៃផែនការអភិវឌ្ឍន៍ឃុំ សង្កាត់ និងផែនការវិនិយោគឃុំ សង្កាត់

ជារៀងរាល់ឆ្នាំ ឃុំ សង្កាត់មានការសម្រេចចិត្តសំខាន់ៗចំនួន ៣ ទាក់ទងនឹងការអភិវឌ្ឍថវិការបស់ខ្លួន។ ទីមួយគឺត្រូវពិនិត្យឡើងវិញ និងធ្វើបច្ចុប្បន្នភាពផែនការអភិវឌ្ឍរយៈពេល ៥ ឆ្នាំរបស់ពួកគេដើម្បីធ្វើឱ្យប្រាកដថា គម្រោងទាំងនេះត្រូវបានអនុវត្តស្របតាមអាទិភាពរបស់ពួកគេ។ បញ្ជីអាទិភាពនៃសកម្មភាពអាទិភាពត្រូវបានដាក់ជូននៅឯសិក្ខាសាលាសមាហរណកម្មផែនការថ្នាក់ស្រុក ខណ្ឌ ដែលផ្តល់វេទិកាសម្រាប់អង្គការក្រៅរដ្ឋាភិបាល និងមន្ទីរពាក់ព័ន្ធដើម្បីដោះស្រាយអាទិភាពឃុំដោយធ្វើការប្តេជ្ញាចិត្តបណ្តោះអាសន្ន។ បន្ទាប់ពីសិក្ខាសាលាសមាហរណកម្មផែនការថ្នាក់ស្រុក ខណ្ឌ ក្រុមប្រឹក្សាឃុំ សង្កាត់អនុម័តសេចក្តីសម្រេចចុងក្រោយស្តីពីការប្រើប្រាស់មូលនិធិអភិវឌ្ឍន៍ផ្ទាល់ខ្លួនសម្រាប់ឆ្នាំនេះដោយពិចារណាលើអនុសាសន៍របស់គណៈកម្មាធិការផែនការ និងថវិកា។

ការសម្រេចចិត្តសំខាន់ទី ២ គឺសំដៅទៅលើដំណាក់កាលអនុវត្តគម្រោងដោយខ្លួនឯង។ ឃុំ សង្កាត់ត្រូវជ្រើសរើសភ្នាក់ងារអនុវត្ត ឬអ្នកសាងសង់ដែលសមស្របដើម្បីអនុវត្តការវិនិយោគ។ ការសម្រេចចិត្តនេះត្រូវបានគ្រប់គ្រងដោយបទប្បញ្ញត្តិលទ្ធកម្មដែលចែងថា វាត្រូវតែធ្វើតាមរយៈដំណើរការដេញថ្លៃដែលសម្របសម្រួលដោយមន្ត្រីខេត្ត។

ចុងបញ្ចប់ជារៀងរាល់ឆ្នាំ ឃុំ សង្កាត់ត្រូវផ្តល់សិទ្ធិឱ្យអ្នកសាងសង់បង់ប្រាក់នៅពេលដែលដំណាក់កាលនីមួយៗនៃការអនុវត្តត្រូវបានបញ្ចប់។ នេះជាជំហានចាំបាច់ក្នុងដំណើរការត្រួតពិនិត្យ ព្រោះក្រុមប្រឹក្សាត្រូវតែធានានូវគុណភាពគម្រោង ហើយនៅពេលដែលមិនបានបំពេញតាមស្តង់ដារគុណភាព ក្រុមប្រឹក្សាគួរតែធ្វើការជាមួយអ្នកសាងសង់ដើម្បីជួយពួកគេឱ្យសម្រេចនូវអ្វីដែលចាំបាច់។

ឯកសារយោង

- 1. រាជរដ្ឋាភិបាលកម្ពុជា, «រដ្ឋធម្មនុញ្ញនៃព្រះរាជាណាចក្រកម្ពុជា» ឆ្នាំ២០០៨។ ចូលអាននៅថ្ងៃទី១៥ ខែតុលា ឆ្នាំ២០២០។

- 2. ដូចឯកសារយោងខាងដើម។

- 3. រាជរដ្ឋាភិបាលកម្ពុជា, «ច្បាប់ស្តីពី ការគ្រប់គ្រងរដ្ឋបាលរាជធានី ខេត្ត ក្រុង ស្រុក ខណ្ឌ» ឆ្នាំ២០០៨។ ចូលអាននៅថ្ងៃទី១៥ ខែតុលា ឆ្នាំ២០២០។

- 4. រាជរដ្ឋាភិបាលកម្ពុជា, «ច្បាប់ស្តីពីរបបហិរញ្ញវត្ថុ និងការគ្រប់គ្រងទ្រព្យសម្បត្តិសម្រាប់រដ្ឋបាលថ្នាក់ក្រោមជាតិ» ខែមករា ឆ្នាំ២០១២។ ចូលអាននៅថ្ងៃទី១៥ ខែតុលា ឆ្នាំ២០២០។

- 5. ធនាគារអភិវឌ្ឍន៍អាស៊ី, «កំណែទម្រង់វិមជ្ឈការសារពើពន្ធនៅកម្ពុជា៖ វឌ្ឍនភាពក្នុងរយៈពេលមួយទសវត្សរ៍កន្លងមក និងឱកាស» ខែធ្នូ ឆ្នាំ២០១៨។ ចូលអាននៅថ្ងៃទី២០ ខែតុលា ឆ្នាំ២០២០។

- 6. ដូចឯកសារយោងខាងដើម។

- 7. ដូចឯកសារយោងខាងដើម។

- 8. ដូចឯកសារយោងខាងដើម។

- 9. ធនាគារពិភពលោក, «សំឡេង ជម្រើស និងការសម្រេចចិត្ត៖ ការសិក្សាអំពីដំណើរការអភិបាលកិច្ចមូលដ្ឋាននៅកម្ពុជា» ឆ្នាំ២០១១។ ចូលអាននៅថ្ងៃទី២០ ខែតុលា ឆ្នាំ២០២០។

- 10. រាជរដ្ឋាភិបាលកម្ពុជា, «ច្បាប់ស្តីពីការគ្រប់គ្រងរដ្ឋបាលឃុំ សង្កាត់» ឆ្នាំ២០០១។ ចូលអាននៅថ្ងៃទី១៥ ខែតុលា ឆ្នាំ២០២០។

- 11. ធនាគារពិភពលោក, «សំឡេង ជម្រើស និងការសម្រេចចិត្ត៖ ការសិក្សាអំពីដំណើរការអភិបាលកិច្ចមូលដ្ឋាននៅកម្ពុជា» ឆ្នាំ២០១១។ ចូលអាននៅថ្ងៃទី២០ ខែតុលា ឆ្នាំ២០២០។